Introduction to Mathematically Perfected Economy

It is not easy to summarize Mathematically Perfected Economy, because it has many ramifications. I tried to keep my answer lean, but it is nearly impossible. So, I ask you beforehand not to be upset by the extensiveness of this message.

MPE is basically a set of proven mathematical principles that identifies and clarifies the true nature of currency, and its life-cycle. It is a long-standing proof (a proven mathematical theorem, rather than simply a theory) of singular solution to the faults of any prospective economy. In the end it is a platform for the restoration of rights, and the rectification of the monetary systems across the world. A complete prescription for the transformation of the current systems of exploitation into a proven just system.

It also categorically refutes any and all other “monetary reform” propositions out there, showing how and why they can only result in economic improprieties and eventually in terminal economic failure. MPE was first introduced in 1968, by Mike Montagne, but it was during the 70’s that he tried to reach politicians, hoping to warn them about the most damaging problems we face because of the absurd way the monetary system is set up. Since, and including Gerald Ford, all American presidents and many candidates received letters with these proofs from Mike.

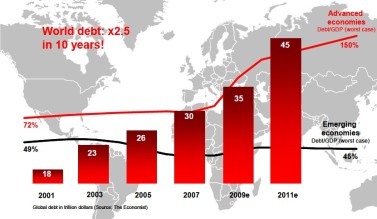

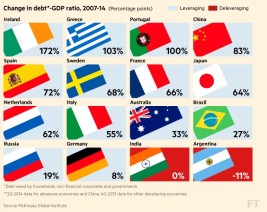

Our models from 1984 predicted monetary failure around 2010.

The Reagan campaign was the first that responded to him. In 1983/84, the author of MPE created a computer model and provided the Reagan administration with it. This model could project when the terminal failure of the current monetary system would transpire. They understood Mike was right about his premises, however they only wanted to know when the economy would enter the terminal stage of failure, instead of tackling the inherent injustices of this system that can only exploit it’s subjects. The computer model projected, due to the data they provided, that the global terminal failure would transpire approximately 2010.

MPE proves how banks commit the most severe crimes against the people, by laundering all ‘principal’ ever created, into their unwarranted possession, and by then multiplying those initial sums of falsified debt – by way of the unjustifiable imposition of interest/usury – into terminal sums of insoluble falsified debts.

Here we are, in 2018, and the current system can only be preserved (for the benefit of the few) with what we call ‘artificial sustention’, otherwise known as Quantitative Easening (QE), which is the artificial introduction of huge amounts of liquidity into circulation, attempting to avoid a general collapse of all industries.

Origins of money

They, the banks, are in truth, mere publishers of the evidence of the peoples’ ‘promissory obligations’ to each other. To understand what this means, I think it is necessary to understand the origins of money first:

Since the conception of money, nearly 5 thousand years ago, in the region of Sumeria, the system of credit was introduced to facilitate the exchanges between people, and the vehicle that allowed that to happen, was what we now call ‘promissory obligations’.

Since that time, money comes into existence through promissory notation. But, this fact has been obfuscated and distorted through the centuries. In antiquity, the money used, in commercial arrangements, were clay tablets, made to register obligations between producers. This means that the accounts of so-called economists and historians, who say gold and precious metals were the first “type” of money that men used to substitute for barter, is yet another misconception, generally spread to keep the exploitation and obfuscation in place.

A Promissory Obligation represents the commitment of an issuer of money, to redeem that note with his own production. So, a creditworthy individual, when lacking ‘notes’ to acquire the production of another productive person, issues a promissory obligation and promises to pay with his own labour/production, in equal measures to that which he has acquired.

This is how money used to function in ancient times: a producer of chickens who wanted to increase his production, and needed chicken feed to reach that goal, would approach a producer of grains and issue to him a promissory note, promising to redeem it with so many chickens, in exchange for so many kilos of grains. The grain producer would give him credit and accept the notes of that obligor. That meant that, he, the grain producer, was the creditor, and that piece of paper or clay tablet was money; or the evidence of his entitlement; a token of value; currency.

That note could then circulate, because the creditor could use it to acquire the production of others, who also accepted that type of note, believing as they did, that it would be redeemed for the chickens of the original issuer. Once redeemed, the promissory note was naturally retired, because, and this is crucial, that promise had been fulfilled.

Despite the lies that we have today, fulfilled promises are property of no one. They become naturally null and void upon fulfilment, otherwise there is fraud.

The (terminal) obfuscation of our promissory obligations

The money we have today is still born out of the promissory obligations of the people. When we enter a bank and ask for a ‘loan’ to buy a home, for instance, the sum we purportedly borrow, is created only after we sign the promissory notes, and the banking system then charge us interest, when they never even had that money in the first place. They simply publish secondary representations of the actual issuer’s promissory obligations, claiming prior ownership of the tokens of value, that the true creditor (the constructor of that home in this case) receives. And then, they charge the true issuer of money interest – properly called usury – as if they had actually given up ‘commensurable consideration of value’, or property of their own.

But the fact is, that NO ‘borrowing’, at all takes place in those loan or mortgage ‘agreements’. Banks simply do not own, so therefore cannot loan, the money that they insist that we must borrow from them, in the form of their purported “loan and mortgages”. No bank ever signs these documents either, further confirming that production of money is an “unilateral commitment to pay”, not a “bilateral contract to pay back”. The work called “Modern Money Mechanics”, produced by the Federal Reserve of Chicago, is an admission of this reality.

It is vital to understand, that the banks do not even create money ‘out of thin air’ as so many “monetary reformists” claim, because it is the PEOPLE who create money, not banks, and it is created out of the PEOPLE’S ability and capacity to produce and redeem that original obligation, even though the further imposition of interest depletes this ability and engenders defaults.

The bank is not the real creditor even, because it is the previous owner or constructor of the related home that is. This is the most monumental crime ever perpetrated against humanity, because all sorts of aberrations, subversion of reality and other crimes or symptoms that the honest people of the world contend with and face, are derived from this original absurdity.

In truth, the banking industry takes no risk at all. Neither do they, ever, lend us any money, at all; neither from their own funds, not from that of their depositors. All money, apart from perhaps the approximately 3% that is coined and printed into existence by government, is created solely by the signatures of the “purported” borrowers.

Even the ‘expansion of the monetary base’, claimed by so-called economists, is completely absurd. It is an attempt to create money, to allegedly pay for government projects through bonds, pieces of paper, which are generally bought by the very same banks that rob the people, at interest anyway. Then, another huge injustice that is carried out, as the people are obliged to work and are taxed to pay for ever escalating sums of artificial debt. But even these bonds are themselves just ‘promissory obligations’, signed, as they are, by those who merely purport to actually ‘represent’ the ‘will of the people’.

MPE

I too had never heard of MPE, prior to 2007. Despite long personal research into monetary reform. But, once I grasped MPE’s basic concepts and mathematical logic, and after diligently studying it, I came to the inevitable conclusion that it was, without doubt, the single solution that we must all unite around and implement, if we are ever to prevail against injustice, and restore monetary rectitude.

To begin with, there are some basic unequivocal principles that no other monetary reform group is correctly identifying and addressing.

- WE, as individuals, create money, because money is a representation of our labour and production; and WE are the true creditors, as only WE even can produce and exchange our production for promissory obligations, also known as money.

- Money, in its purest form, is simply a ‘representation of entitlement’, enabling us to draw on the ‘overall pool of wealth’. It allows a creditworthy party, or individual, to issue a ‘promise to pay’ for the production that a true creditor (not a bank) gives up.

This is the true nature of money: a Promissory Obligation to pay back to the ‘pool of wealth’ (goods and services), in equal measure, to that which the issuer has taken from it. In other words, it is an obligation to redeem the ‘Promissory Notes’, with an equivalent production to that which was acquired from the actual creditor.

I know that these core principles may at first seem a little complex, but, it is the very fact that the people have handed over and abrogated their responsibility to understand money, that has led to the ‘take over’ of us all by the ruse called banking in the first place.

Mike and the “economic” teacher

At this point, I think it would be important to mention a discussion that took place when Mike Montagne was 16 years old, and he was attending an economics lecture.

Before he got there, he was already considered to have advanced knowledge of mathematics for his age.

His teacher was explaining the widely held theory of monetary inflation, and its alleged effects.

The teacher then used the accepted explanation, still blindly taught by nearly the entire world, that says that: ‘the expansion of the money supply results in the increase of prices of the products’.

But first, the teacher said that ‘all money was created as debt, subject to interest’. After that, Mike had all the necessary data to identify the impossibility of these mainstream erroneous concepts.

Because if all money is created as a debt, subject to interest – and given that inflation and deflation are commonly defined, respectively, as increases or decreases of money in circulation per goods and services (represented wealth) – it is impossible to even suffer from too much money in circulation, per represented wealth.

His first question to his teacher, back in 1968, was:

“If all the money is loaned into circulation as debt, and the debts are subject to interest, and if we cannot borrow more than the value of whatever we are borrowing the money for, it is unclear first of all how it is even possible to suffer what you define to be “inflation.

“In other words, if we can’t borrow $50,000 to buy a $35,000 home or $50 to buy a $20 tire, then how can we possibly ever suffer ‘inflation’?”

And so he unfolded it, unravelling the underlying mechanics of the current monetary system:

“We have an inherently, irreversibly multiplying sum of debt [by interest], which ultimately engenders collapse, and which, all along the irreversible path to that collapse, imposes ever greater costs of servicing ever greater debt. While I can understand that these costs manifest in ever greater prices as industry has to account for their erosion of profit margins, it is also true that ever less of the circulation can be devoted to commerce, as ever more of the circulation is inherently devoted instead, to servicing debt. Eventually, even all of the circulation is devoted to servicing debt.”

MPE’s first steps, back then in 1968, already dismantled the common lies of economy that we still carry out in 2018.

In the subsequent years, Mike developed the theory into a whole, rounded out, theorem; the answers, and solution, to the inherent problems of this model of economy we are all in.

The solution is relatively simple, and it doesn’t take too much effort to comprehend it.

There is only one solution to any mathematic riddle, and in fact, MPE is the only veritable and accountable solution to the monetary aspects of any prospective economy:

1) Inflation and deflation;

2) Systemic manipulation of the cost or value of money or property;

3) Inherently irreversible multiplication of falsified debt by interest.

1) As inflation and deflation are defined as increases or decreases of money in circulation in relation to the represented wealth, then only a circulation which is perpetually equal to the remaining value of all represented wealth can eradicate both problems.

2) Systemic manipulation, which is a combination of faults 1 and 3, culminates in dispossession of the unwitting victims, and huge amounts of money and property being unwarrantedly taken from the people, and made available to those who take advantage of the crimes imposed on the rest of us. All this is solved by the combination of the solutions for faults 1 and 3.

3) The solution for the inevitable escalation of falsified debts to mere publishers of money by interest, is the complete eradication of interest/usury.

THE EQUATION –

MPE will eradicate the potential faults and allow industry to prosper to the full extent it is capable of, by establishing a perpetual 1:1:1 relationship (ratio) between:

– Remaining money in circulation;

– Remaining value of all represented property;

– Remaining obligation to pay just that much for the value of represented property.

Money is to be created, and to enter into circulation, to represent value of property; the representations (money) are to be retired according to the rates of consumption of the related properties; the properties depreciate at the same rate.

THE PRINCIPLE –

Under MPE, we only pay for what we consume, as we consume of the related properties.

Only under MPE will the people have ‘immutable’ tokens of value. In other words, the money earned will have the same purchasing power throughout time. The unit of value will not suffer the unwarranted consequences of inflation or deflation. Therefore, the people will not see their entitlements drained invisibly into the hands of criminals.

It is easy to understand, that under the current system of interest, we have our labour exploited by deftly concealed mechanisms, as the money we earn today cannot buy the same things throughout time. It is a modern equivalent of servitude or slavery, perpetrated against the people.

MPE will accomplish its objectives by restoring the universal right of individuals, to issue their own unexploited promissory obligations to actual creditors, free of extrinsic manipulation, or adulteration. And by adopting the obligatory schedule of payment, to retire (extinguish) the promissory notes from circulation, at the rate of consumption or depreciation of the related properties.

We use the basic example of a home to better explain how MPE will function. Under a rectified economy, a $100.000 home with a rate of consumption or depreciation of 100 years, will cost to the issuer/obligor only $1.000 per year, or $83.33 per month (considering a linear rate).

Expanding on that example, a person who wants to buy that home, monetizes the property through what will be called the Common Monetary Infrastructure (CMI), which will be a transparent body of government, fully controlled by, and fully accountable to the people.

Then, the previous owner/creditor of the home, will be credited in his account, the full principal from the outset ($100 K). And, the issuer/obligor, commits himself to pay for the home at its rate of depreciation.

THERE IS NO USURY UNDER MPE.

Under MPE, instead of paying sufficient to actually buy 2, 3 or 4 houses in order to secure just 1, and even then, being subject to failure and to losing that house in the process (even when it’s been already paid), all due to dispossession, inherent in deflationary circulation as we have to endure today, the creditworthy individuals [certified by simple mathematics] will pay for just 1 house.

In the end, MPE is the equivalent to a ‘monetized barter system’, with the enhancements of a just and accountable credit system added; one which, by its very design, simply cannot inflict any injustice upon society, as it maintains an immutable representation of entitlement which is the only reason for money to exist.

The transition to MPE will count all ‘prior payments’ of interest, instead towards ‘principal’. For example, if someone payed for a home worth $100K, $50K in principal, and $50K in interest, then this person would be deemed to have ‘paid in full’ for the property, and no further payments of funds would be required for that house.

“Absolute Consensual Representation” (ACR) is the other crucial second strand of the work we do in support of Mike Montagne’s work. ACR is a political reform of the voting system, that allows the MPE transformation to take place. It is a set of principles of representation that prevents corruption and establishes the sovereignty of the people.

The amendments, with the prescriptions for each, can be found at: https://australia4mpe.wordpress.com/united-peoples-mandate-amendment/

Please, don’t hesitate to ask me any questions. This issue is absolutely vital, it is the single most important set of principles imaginable, and it is a genuine piece of history that is just waiting to be written by those who see it for what it is. Not just for our own benefit, but for the benefit of all future generations to come. The responsibility to put an end to this aged old crime perpetrated against humanity is on us.